The First Ever 30 Year Fixed in 1934

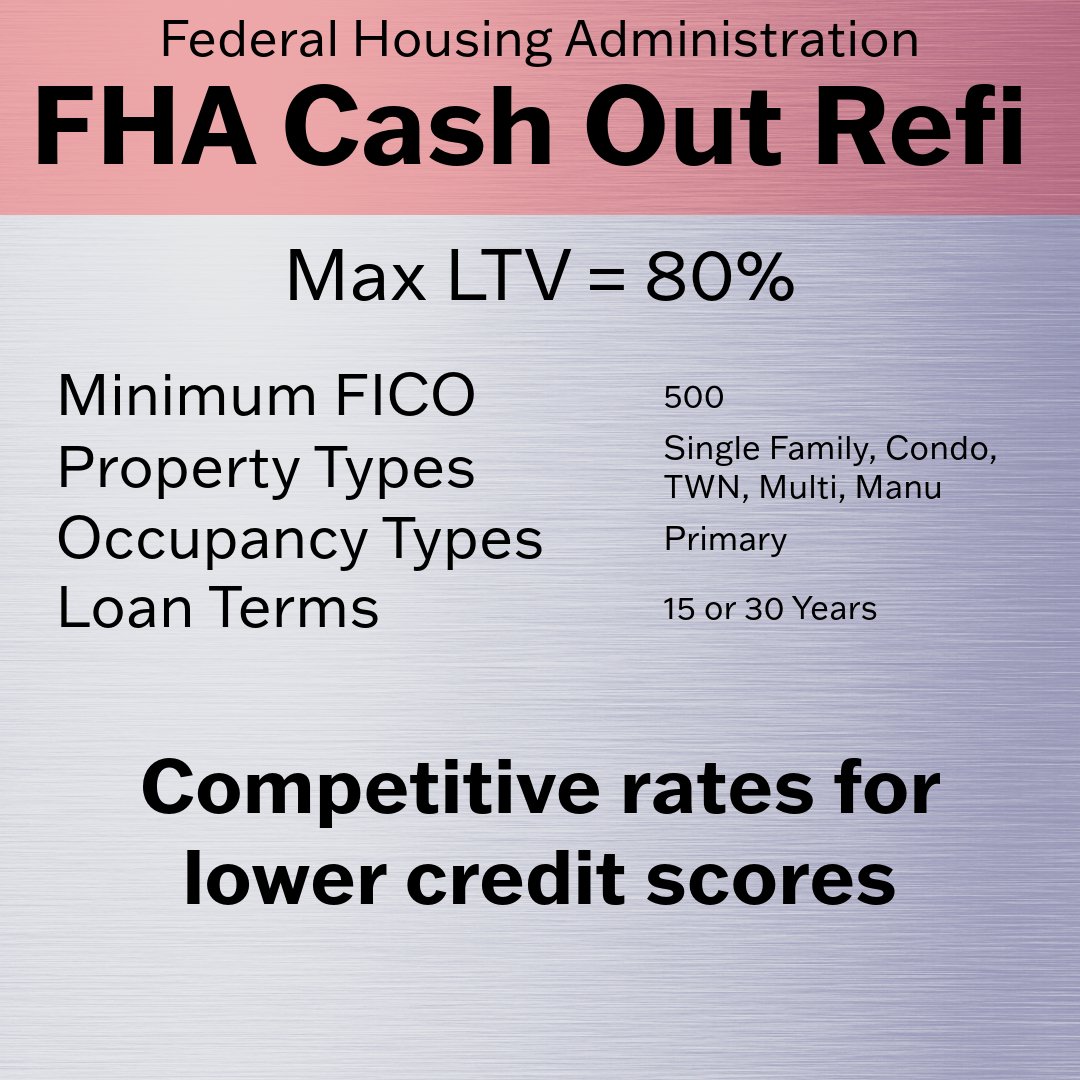

Key Loan Details

Best Terms for Borrowers With Less Than Perfect Credit: For those with credit scores below 700, an FHA loan may present the most advantageous terms.

Cash Out for Any Reason: Open to all, this option allows for taking as much cash as you want up to 80% of your home’s value. If you’re doing some renovations check out our FHA 203k Program where you can get more than 80% if it’s used for renovations that will increase the value of the property.

Flexible Credit Requirements: Take cash out as long as your credit score is above 500.

FHA Upfront Mortgage Insurance Premium: This fee is added onto your final loan amount so you don’t have to pay it upfront, but it’s not a small fee. The FHA Upfront Mortgage Insurance Premium(UFMIP) is 1.75% of your loan amount. This provides the support needed to maintain the FHA guarantee and is essential for keeping this program going.