The Most Common Type of Mortgage

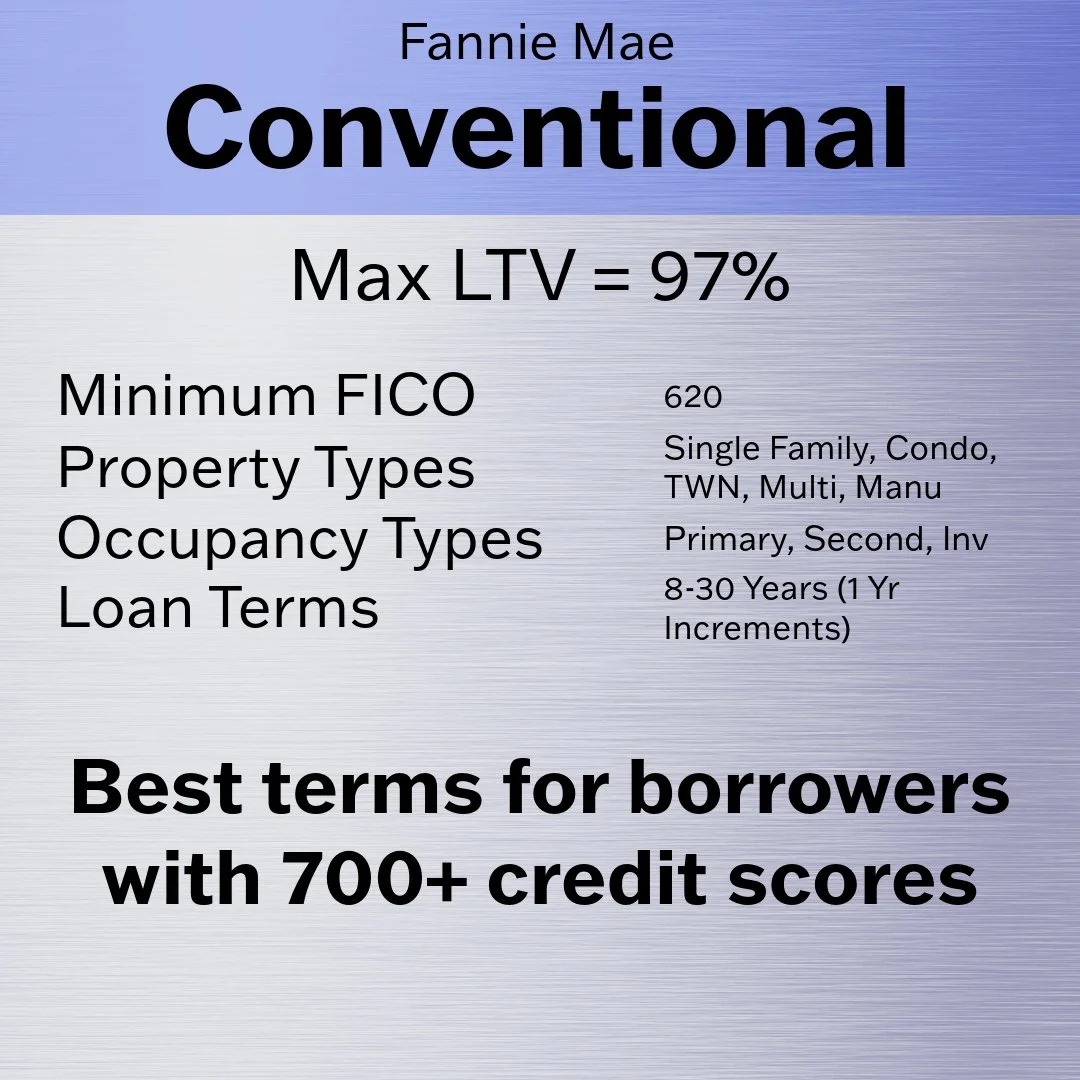

Key Loan Details (Purchase or Refinance)

Best Terms for Most Borrowers: It’s the most popular because it offers the best terms for most people. That means the lowest payment for the least cost.

HomeReady: A special type of Conventional loan only for First Time Home Buyers making less than 80% Area Median Income. Fannie Mae waives significant pricing adjustments, which means you get a better rate if you qualify.

HomeStyle: Fannie Mae’s renovation loan program designed to finance renovation costs. Your down payment is a percentage of the completed value after renovations, as little as 3%.

Funding Sources: Down payments and closing costs can be covered through gifts, grants, or Community Seconds®, with no minimum personal contribution required.