Unlocking the Benefits of CHOICEReno

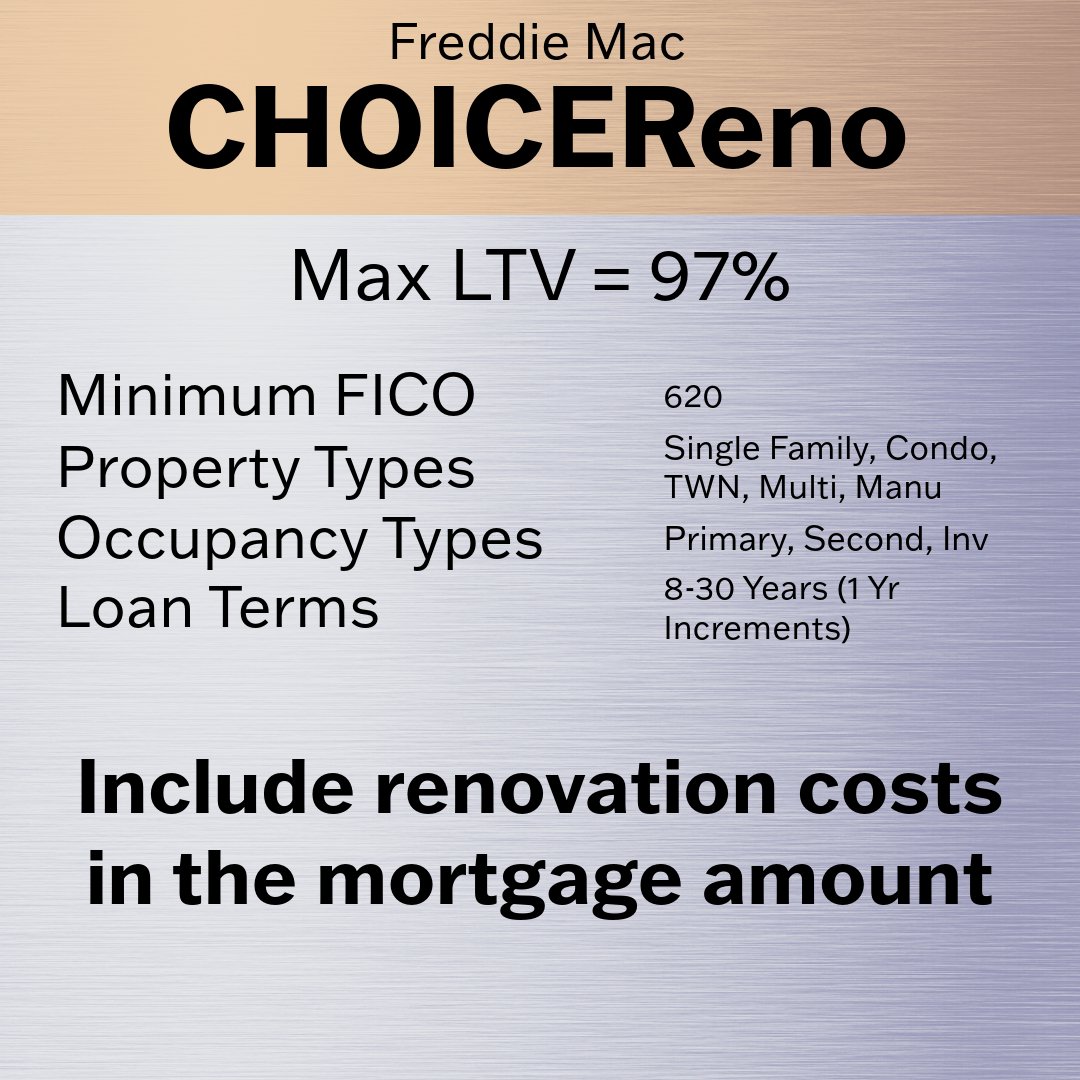

Key Loan Details

Purchase or Refinance - You can buy a home that needs repairs, or remodel your current home.

Allows Renovation Costs to be Financed: Maximum renovation funds can be up to 75% of the “as completed” value!

CHOICEReno eXPress: A streamlined option for borrowers looking to finance small-scale renovations.

Combine With HomePossible: You can combine the renovation loan with the affordability program.

Funding Sources: Down payments and closing costs can be covered through gifts, grants, or Community Seconds®, with no minimum personal contribution required.

Investment Opportunity: CHOICEReno can also be used for investment properties.

Overcoming Obstacles: Even if a property is not perfect or there are eligibility issues, CHOICEReno can help you overcome these obstacles and turn the property into what you need.

References

-

-

-

CHOICERenovation Homepage

-