Unlocking the Benefits of HomeReady

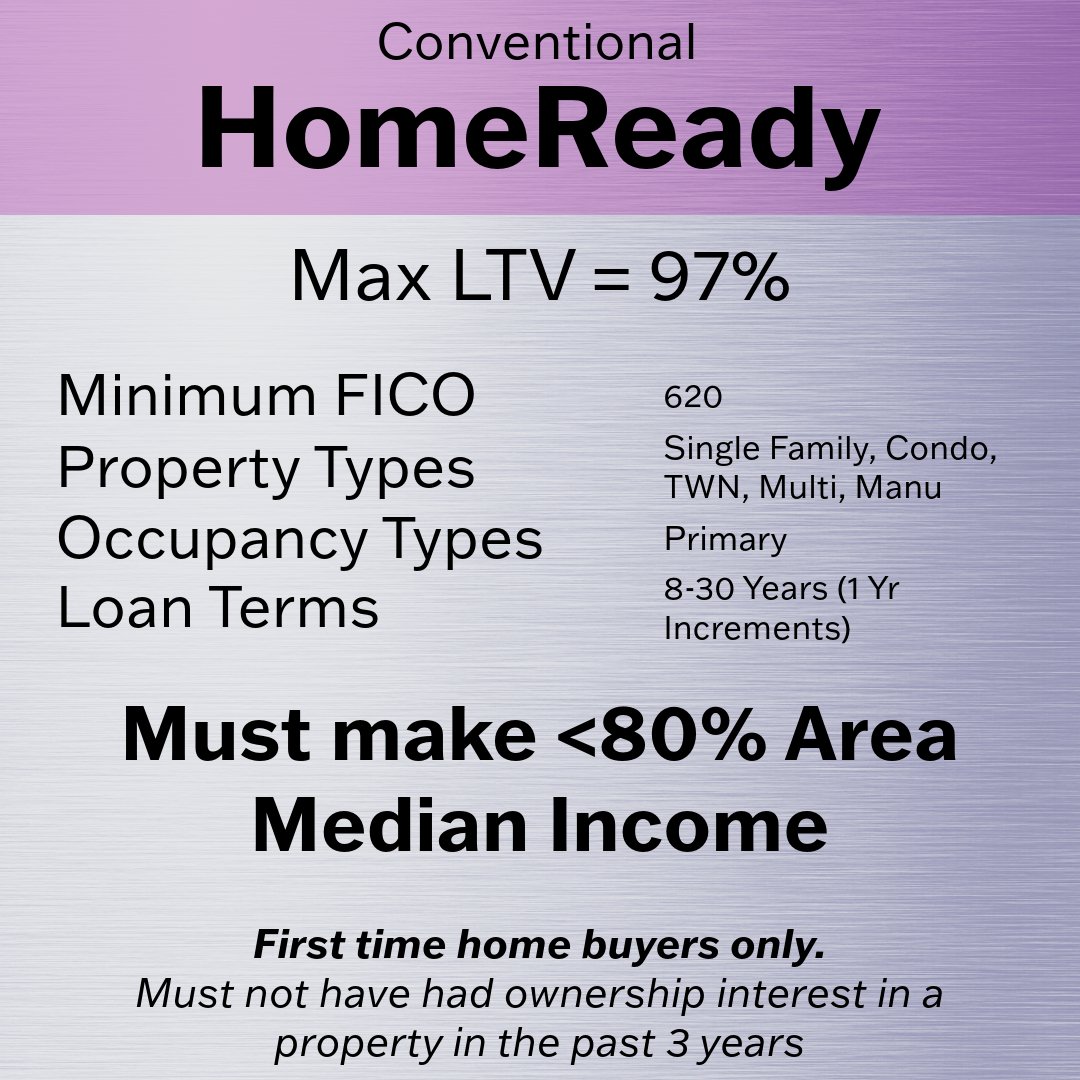

Key Loan Details

First Time Homebuyer Requirement: Only for first time home buyers. (Home Possible by Freddie Mac does not have this requirement)

Required Education: Fannie Mae requires the completion of first time home buyer education. (HomePossible by Freddie Mac does not require education if at least one borrower has owned a home in the past)

Pricing Adjustment Waivers: Fannie Mae waives many pricing adjustments for first time home buyers, that means you get a better rate if you qualify.

Funding Sources: Down payments and closing costs can be covered through gifts, grants, or Community Seconds®, with no minimum personal contribution required.

Rental Income: Includes potential rental income from a boarder or an accessory dwelling unit (ADU) in qualifying income calculations, broadening eligibility.

Mortgage Insurance: Reduced coverage requirement for loans above 90% LTV.

References