Who Does Your Loan Officer Really Work For?

You wouldn’t walk into a Ford dealership expecting them to recommend a Chevy— even if a Chevy was a better fit for your family.

Yet every day, homebuyers talk to mortgage lenders expecting unbiased advice about their loan options. The truth? If your loan officer works for the lender, their loyalty isn’t to you — it’s to their employer.

That’s not because they’re dishonest or don’t care about you. It’s because, by law, a lender’s loan officer has a fiduciary duty to the lender — not to the client. Their job is to represent the lender’s best interests, not to shop for the best deal on your behalf.

A mortgage broker, on the other hand, is an independent professional. Think of them as the person who stepped out of that Ford dealership to walk across the street with you — helping you compare all the options, across all the brands, until you find the one that’s best for you.

That independence changes everything.

Inside the Lender: How the “In-House” Model Works

When you go directly to a mortgage lender — a bank, credit union, or “direct” lender — you’re working with a loan officer and processor who are employees of that company.

They’re good people doing their best work. But they operate within a system that controls their every move:

Their loan options are limited to that lender’s internal programs.

Their rates and fees are set by that company’s pricing model.

Their priority is to close loans for the lender, not to compare competitors.

Their direction comes from management — not the client.

Their legal/fiduciary duty is to act in the best interest of their employer, not you.

So when you ask, “Is this the best loan I can get?” — their answer can only come from what their company offers.

The Broker Model: Standing With the Client

When you work with a mortgage broker, something fundamental changes.

The loan officer and processor roles — the people who guide you through your loan — work from outside of the lender’s organization and operate independently.

That single shift creates accountability and advocacy that simply can’t exist inside a lender’s corporate structure.

Here’s why:

A broker’s employer is you.

A broker’s options include many lenders — meaning they can compare rates, terms, and programs from several sources.

In simple terms:

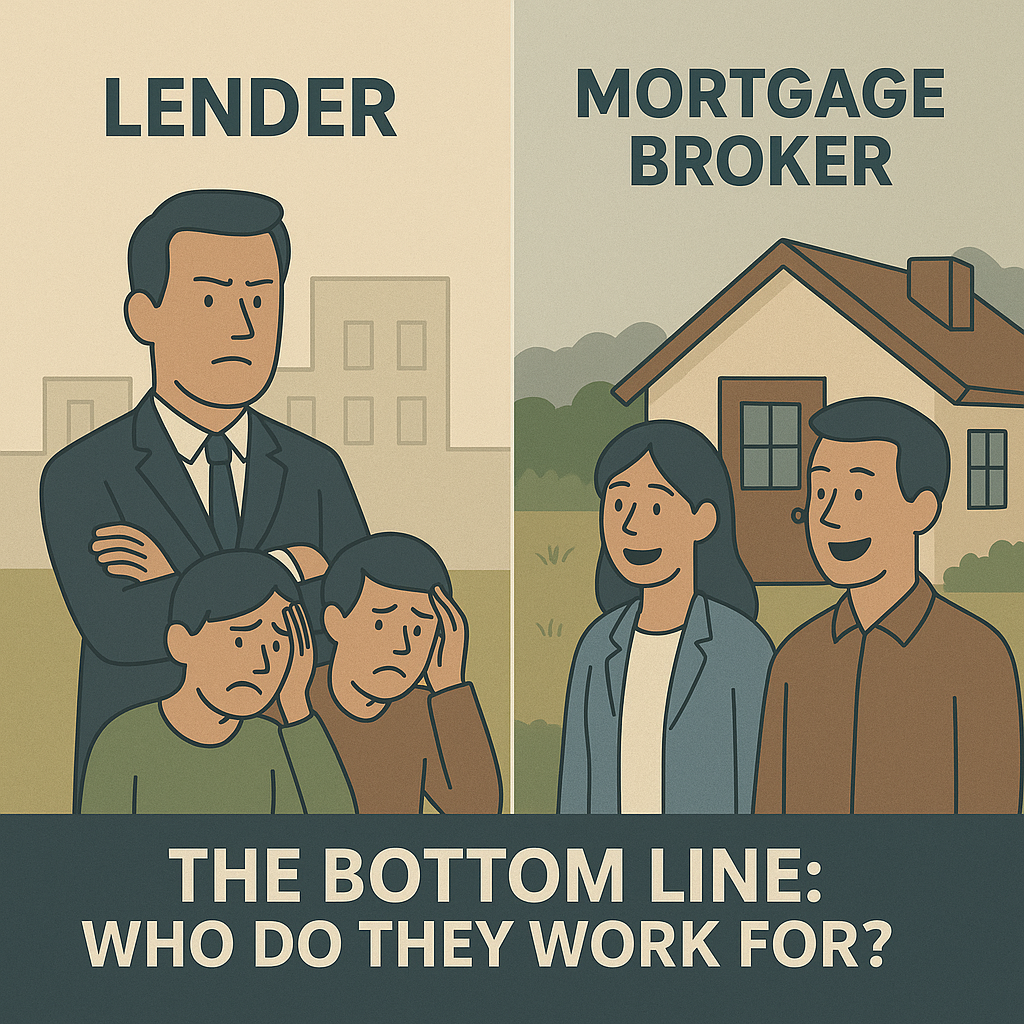

A lender’s loan officer works for the company.

A mortgage broker works for you.

That’s the difference between having a salesperson trying to sell you something and having an advisor helping you choose what’s best for you.

Real-World Example: The Ford vs. Chevy Analogy

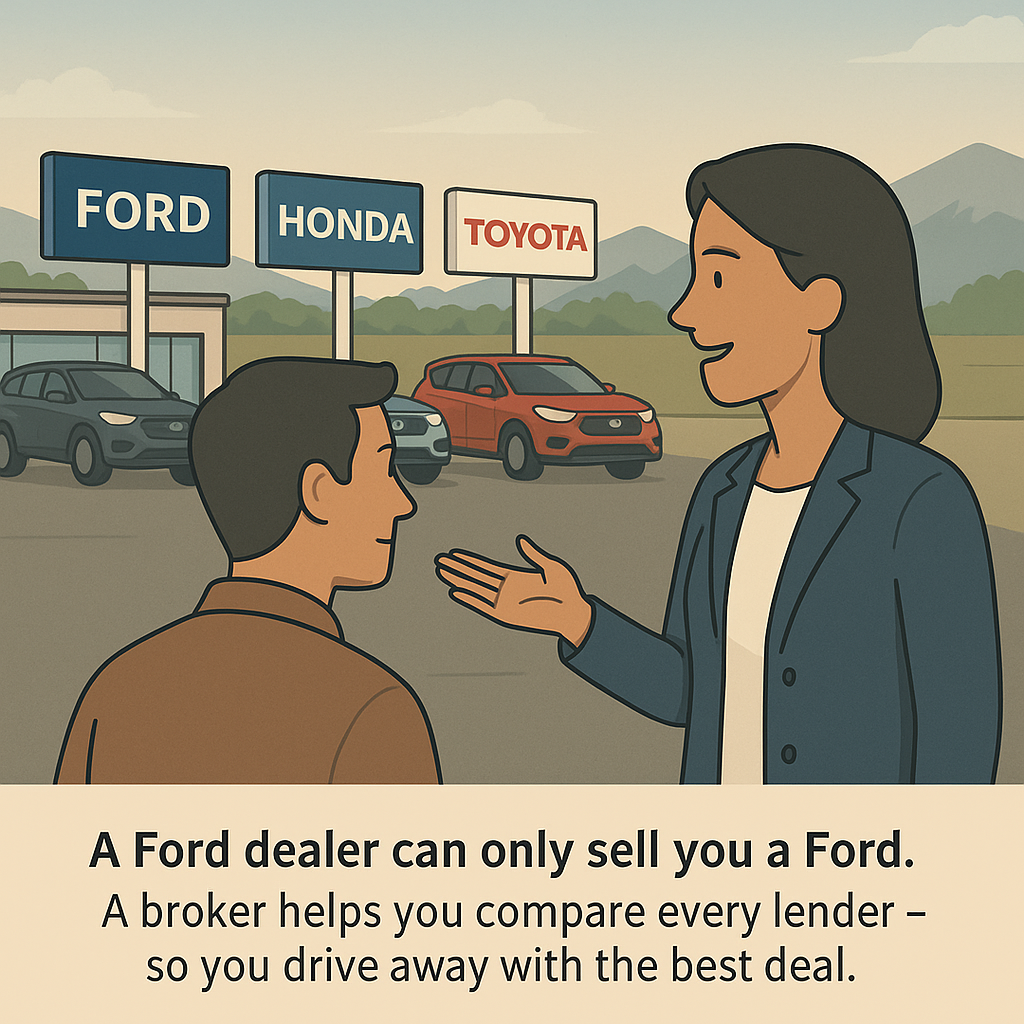

Let’s go back to that car example.

When you visit a Ford dealership and say, “I’m looking for a reliable SUV for my family,” they’ll do everything possible to sell you a Ford Explorer.

But what if a Chevy Traverse, Honda CR-V or a Toyota Highlander actually fits your budget, mileage needs, or comfort preferences better? The Ford salesperson isn’t going to send you across the street to check those out — because that’s not how their job works.

Now imagine instead you have an independent car consultant — someone who isn’t employed by Ford, Chevy, or Toyota. Their only job is to find you the best SUV for your lifestyle, price range, and goals.

That’s what a mortgage broker does.

They don’t work for the lenders. They work with the lenders — and for you.

The Bottom Line

If you take one thing away from this article, it should be this:

When your mortgage professional works for the lender, the lender wins.

When they work for you, you win.

Independence isn’t just a business model — it’s a client protection model. It’s the structure that creates real accountability, genuine advocacy, and better outcomes for Colorado homebuyers.

Ready to experience the difference?

Before you walk into a lender’s office, talk to an independent mortgage broker. We’ll compare options side-by-side and show you exactly how much that independence can save you.

📞 Call 970-480-0540

🏡 Montezuma Mortgage — NMLS #1880546

⚖️ Regulated by the Colorado Division of Real Estate